Republicans Destroyed U.S. Economy According to Ronald Reagan’s Director of the Office of Management and Budget – David Stockman was director of the Office of Management and Budget under President Ronald Reagan. Following are excerpts from an opinion piece he wrote in the NY Times.

If there were such a thing as Chapter 11 for politicians, the Republican push to extend the unaffordable Bush tax cuts would amount to a bankruptcy filing.

It is therefore unseemly for the Senate minority leader, Mitch McConnell, to insist that the nation’s wealthiest taxpayers be spared even a three-percentage-point rate increase.

More fundamentally, Mr. McConnell’s stand puts the lie to the Republican pretense that its new monetarist and supply-side doctrines are rooted in its traditional financial philosophy. This approach has not simply made a mockery of traditional party ideals. It has also led to the serial financial bubbles and Wall Street depredations that have crippled our economy. More specifically, the new policy doctrines have caused four great deformations of the national economy, and modern Republicans have turned a blind eye to each one.

In the end it was a new cadre of ideological tax-cutters who killed the Republicans’ fiscal religion. By fiscal year 2009, the tax-cutters had reduced federal revenues to 15 percent of gross domestic product, lower than they had been since the 1940s. Then, after rarely vetoing a budget bill and engaging in two unfinanced foreign military adventures, George W. Bush surrendered on domestic spending cuts, too — signing into law $420 billion in non-defense appropriations, a 65 percent gain from the $260 billion he had inherited eight years earlier.

The third ominous change in the American economy has been the vast, unproductive expansion of our financial sector. Here, Republicans have been oblivious to the grave danger of flooding financial markets with freely printed money and, at the same time, removing traditional restrictions on leverage and speculation. As a result, the combined assets of conventional banks and the so-called shadow banking system (including investment banks and finance companies) grew from a mere $500 billion in 1970 to $30 trillion by September 2008.

It is not surprising, then, that during the last bubble (from 2002 to 2006) the top 1 percent of Americans — paid mainly from the Wall Street casino — received two-thirds of the gain in national income, while the bottom 90 percent — mainly dependent on Main Street’s shrinking economy — got only 12 percent. This growing wealth gap is not the market’s fault. It’s the decaying fruit of bad economic policy.

The Fiscal Crisis Was Predicted and Planned – The following are excerpts from a piece originally published in the New York Times on 9/14/2003 (during G. W. Bush’s first term):

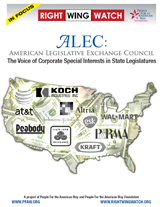

So what were the Bush tax cuts really about? The best answer seems to be that they were about securing a key part of the Republican base. Wealthy campaign contributors have a lot to gain from lower taxes, and since they aren’t very likely to depend on Medicare, Social Security or Medicaid, they won’t suffer if the beast gets starved. Equally important was the support of the party’s intelligentsia, nurtured by policy centers like Heritage and professionally committed to the tax-cut crusade. The original Bush tax-cut proposal was devised in late 1999 not to win votes in the national election but to fend off a primary challenge from the supply-sider Steve Forbes, the presumptive favorite of that part of the base.

This brings us to the next question: how have these cuts been sold?

At this point, one must be blunt: the selling of the tax cuts has depended heavily on chicanery. The [Bush] administration has used accounting trickery to hide the true budget impact of its proposals, and it has used misleading presentations to conceal the extent to which its tax cuts are tilted toward families with very high income.

David Stockman famously admitted that Reagan’s middle-class tax cuts were a ”Trojan horse” that allowed him to smuggle in what he really wanted, a cut in the top marginal rate. The Bush administration similarly follows a Trojan horse strategy, but an even cleverer one. The core measures in Bush’s tax cuts benefit only the wealthy, but there are additional features that provide significant benefits to some — but only some — middle-class families.

The astonishing political success of the antitax crusade has, more or less deliberately, set the United States up for a fiscal crisis. How we respond to that crisis will determine what kind of country we become.

If Grover Norquist is right — and he has been right about a lot — the coming crisis will allow conservatives to move the nation a long way back toward the kind of limited government we had before Franklin Roosevelt. Lack of revenue, he says, will make it possible for conservative politicians — in the name of fiscal necessity — to dismantle immensely popular government programs that would otherwise have been untouchable.

The tax-cut crusade has created a situation in which something must give. But what gives — whether we decide that the New Deal and the Great Society must go or that taxes aren’t such a bad thing after all — is up to us. The American people must decide what kind of a country we want to be.

Even if Bush Tax Cuts for the Rich Expire, the Rich Still Get Richer – Taxpayers with income of more than $1 million for 2011 would still receive on average a tax cut of about $6,300 compared with what they would have paid under rates in effect until 2001, according to an analysis prepared by the Joint Committee on Taxation.

That compares, however, with the roughly $100,000 average tax cut that households with more than $1 million in income receive under current rates.

Republicans Out-of Touch with Citizens on Social Security – While Republican leaders continue to push for reduction or elimination of Social Security, the latest assessment of Social Security by the American public continues to reflect strong support. On the 75th anniversary of Social Security, public support for the program remains exceedingly high. Consistent with previous anniversary surveys in 2005, 1995, and 1985, a majority of adults age 18 and older believe Social Security is one of the most important government programs and that it provides financial security to older Americans and helps them remain independent. Moreover, the public is inclined to pay more to get the same benefits as today than to see benefits reduced. Given the importance Americans place on Social Security, it is not surprising that they overwhelmingly oppose cutting it to help reduce the federal deficit.

Regards,

Jim